In cases of investment fraud, the victim is contacted by SMS, Whatsapp or another messaging service or by e-mail and is convinced to invest in a financial product or cryptocurrency. For this purpose, the victim is directed to a website where he or she is supposed to register.

Fraudulent trading platforms

In this type of fraud, the victim is directed to a website where he or she is asked to register, after being contacted by the scammers.

The victim is then instructed to make transfers to an IBAN account or to purchase cryptocurrency. The development of the investment can often be followed on the website, where a fantastic return on investment is promised. As soon as a payout is requested, the supposed businessmen however no longer get in touch or blame technical problems.

In the meantime, the invested money has been moved abroad via other accounts or the whereabouts have been concealed by alternative payment methods.

Ponzi scheme

A Ponzi scheme is a form of fraud that initially often appears to be a solid business model. The scammers convince their victims to give them money to invest in an institution such as a hedge fund, or in a cryptocurrency. The promised returns on investment are high for low risks.

However, the scammers usually do not invest the money and therefore do not make any profits, but year after year - using forged documents - they confirm the high returns and that the money keeps growing as promised.

When investors ask for a payout, the managers use the money from other investors to do so.

In other words, the system works as long as enough new investors bring money in the system, which can be used to cover individual payouts, and as long as cash inflows are greater than cash outflows.

The system collapses when numerous investors want their money back simultaneously.

How do you recognize a Ponzi scheme?

One or a combination of these elements requires vigilance:

- high returns with no or low risk

- constant returns

- non-transparent business strategies

- payout (of returns) difficulties.

Preventive advice:

- Only invest in companies if you are sure that they operate reputable business models.

- Always check whether the indicated company really exists or may have attracted negative comments in the past.

- Be generally sceptical if unknown people contact you out of the blue to present business models or investment opportunities.

- Do not act rashly: You should always be sceptical about promises of big profits.

- If you have become a victim of such an investment scam, file a complaint with the Police.

Fraud with the help of cryptocurrency trading platforms

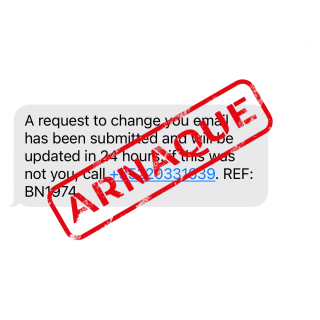

The Police are repeatedly confronted with cases in which users of cryptocurrency trading platforms (e.g. Binance, Coinbase, Kraken, Bitfinex, Crypto.com, Gemini) are targeted by fraudsters. The victims receive an SMS message from the supposed trading platform informing them that someone has tried to log into the victim's account. The victim is then instructed to call a certain number to stop the process.

In the subsequent conversation, the victim is then tricked into transferring the cryptocurrency to a trust wallet and giving the perpetrator further account security information. Once the perpetrator has all the data, he has full access to the account and can transfer the cryptocurrency to another account.

In this regard, we would like to remind you that reputable platforms never ask their customers to transfer their cryptocurrency or send it to another account. In addition, users should be aware that access data and security information (seed phrase, passwords, private key) should never be shared with anyone.